Published on Sept 2017

On Monday, 25th September at 15.00, the ECON (Economic and Monetary Affairs Committee of the European Parliament) welcomed ECB President Mario Draghi for the third Monetary Dialogue of the year in Brussels.

A year ago, the ECON was discussing the moderate peace of the recovery in the euro area, witnessing a slight loss of momentum and assessing the impact of the UK referendum. Over the past 12 months, however, things slightly changed: the recovery has accelerated and broadened, supported by the pass through of the ECB monetary policy. In his remark, yesterday Draghi discussed the current economic outlook and the impact of that policy measures, and then, at the request of the Committee, he focused in particular on two topics relating to the ECB’s monetary policy, namely, the corporate sector purchase programme (CSPP) and IMP implementation across the euro area.

At today, as Draghi assessed, the economic expansion is firm and broad-based across euro area countries and sectors, and real GDP growth was better than expected in the first half of 2017, coming in a 2.3% year on year in the second quarter. The euro area economy has enjoyed 17 consecutive quarters of growth and the latest information indicates continued momentum in the period ahead.

Research shows that this ongoing recovery is crucially driven by domestic forces and that the labour market has notably improved. Indeed, the unemployment rate has fallen to its lowest level in 8 years and the number of people employed has increased by almost 7 million since 2013. These employment gains, together with increasing household wealth, are supporting the private consumption outlook.

Moreover, investment is improving, boiled by the very favourable financing conditions: the domestic drivers are making the recovery more robust and resilient to adverse external influences. According to the September ECB staff’s macroeconomic projections, the economic expansion will continue at growth rates above potential over the projection horizon.

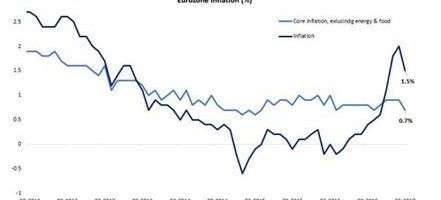

In addition to this, annual real GDP is projected to increase by 2.2% in 2017, by 1.8% in 2018 and 1.7% in 2019. Risks around the euro area are broadly balanced: at the same time downside risk continues to exist, mainly related to global factors and developments in foreign exchange markets. The firm economic recovery still needs to translate more convincingly into stronger inflation dynamics. As he already reported in the past, deflation risks have essentially disappeared. Nevertheless, measure of underlying inflation has picked up only moderately during recent months. Headline inflation, which was 1.5% in August, is expected to temporarily decline towards the turn of the year, driven mainly by base effects in the energy component. Afterwards, it is expected to pick up gradually reaching 1,5% in 2019 according to ECB staff’s projections.

Overall, the ECB is becoming more confident that inflation will eventually head to levels in line with the inflation aim, but also knows that a very substantial degree of monetary policy accommodation is still needed for the upward path to materialize. Indeed, Draghi asserted that the Eurozone still sees some uncertainties with respect to the medium term inflation outlook (“we need to be patient and persistent until absorption of economic slack and price stability that requires policy accommodation”). With this in mind, the ECB will have to decide on a recalibration of instruments that maintain the degree of monetary support that the economy needs to complete its transition to a new balance growth trajectory characterized by sustained conditions of price stability.

The package of monetary policies that the ECB has faced sequentially since June 2014, has led to a significant ease in financing conditions. The Corporate Sector Purchase Programme (CSPP) represents an important credit component of the Asset Purchase Programme (APP). By directly lowering the market-based financing costs of nonfinancial corporation, it boosts the pass through of the monetary policy.

Under the CSPP the euro system has (since June 2016) purchased bonds issued by a wide range of non-bank corporations established in the euro area which include large as well as smaller companies. So far have been purchased assets for an amount closer to 10 billion euros from 200 issuers, from 20 countries across all sectors. Firms have witnessed significant improvements in their financing conditions when issuing bonds, evident across market sectors and segments/countries.

Concluding, we must remember that “a single currency entails a single monetary policy”, keeping in mind that the primary the objective is maintaining price stability for the euro area. Recourse will be made to national central banks for carrying out the operations that form part of the tasks of the euro system to follow a decentralized approach, since securities markets still depend on national specificities and preferences. The monetary union, made up of segmented national financial markets, will hopefully lead to the Eurozone recovery and stability.

Visits: 122